Unveiling the Top Fintech Ideas Garnering Massive Investments

Fintech startups have emerged as darlings of investors seeking lucrative opportunities, with a significant portion of early-stage investments pouring into this sector. In the first quarter of 2021 alone, one in every three dollars of early-stage startup investments in India was directed towards fintech ventures, amounting to a staggering $110 million, as reported by Venture Intelligence. Notably, education finance startup LeapFinance, cryptocurrency trading platform CoinSwitch, and neo banking startup Zolve claimed the lion’s share of these investments, collectively capturing 69% of the total funding.

Revolutionizing Credit Access

Jai Kisan, an Indian startup, has pioneered efforts to facilitate access to loans for individuals lacking documented credit scores, particularly farmers and other underserved segments. Securing a Series-A funding round of $30 million led by Mirae Asset, Jai Kisan aims to bridge the credit gap for individuals with limited or no credit history. Concurrently, other startups are exploring innovative credit models such as the ‘Buy Now Pay Later’ (BNPL) framework, offering consumers convenient access to unsecured credit. Despite higher interest rates, this approach has witnessed substantial adoption, with players like Simpl, LazyPay, and Amazon Pay extending pre-approved credit lines to millions of customers.

Riding the Cryptocurrency Wave

Cryptocurrency has emerged as a lucrative avenue for investors seeking high-risk, high-reward opportunities. With digital currencies like Bitcoin, Ethereum, and Dogecoin reaching unprecedented heights, investor interest in the cryptocurrency market has surged. Notable figures like billionaire investor Mark Cuban have diversified their portfolios by investing in blockchain startups, underscoring the growing prominence of this asset class. CoinSwitch Kuber, a cryptocurrency trading platform, raised $15 million during its Series-A round in January, with subsequent funding rounds signaling sustained investor confidence in this burgeoning sector.

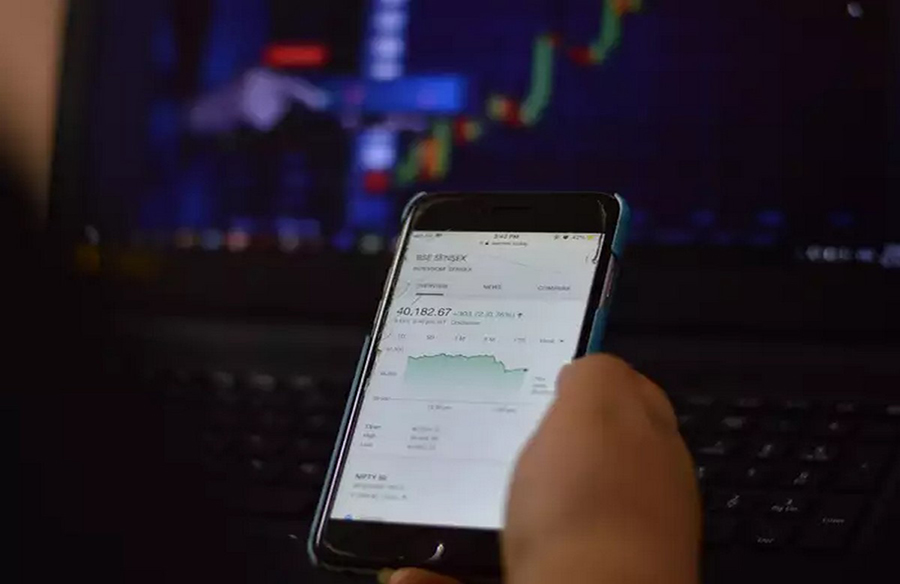

Democratizing Stock Market Access

The pandemic-induced market volatility has spurred millennials and Gen-Z individuals to explore stock market investing, driving significant growth in stock broking startups. Platforms like Zerodha, Groww, and Upstox have witnessed exponential growth, capturing a substantial market share of active demat accounts. These platforms have diversified their offerings beyond traditional stock trading, with services like direct mutual fund investing and digital gold investing gaining traction among users.

Disrupting Insurance Solutions

As financial markets undergo digital transformation, insurance startups are leveraging technology to enhance accessibility and affordability. Plum, a health insurance startup catering to small businesses, recently secured $15.6 million in funding, highlighting investor confidence in the digital insurance segment. By adopting innovative business models like business-to-business-to-customer (B2B2C), startups like Acko Insurance are revolutionizing insurance distribution channels, offering customers greater convenience and cost-effectiveness.

Pioneering New Payment Ecosystems

In a bid to challenge the dominance of the National Payments Corporation of India (NPCI), fintech startups are exploring new payment ecosystems through the establishment of New Umbrella Entities (NUEs). Collaborations between industry players like Paytm, Zeta Pay, Ola, and IndusInd Bank signal a paradigm shift in the payments landscape, with startups vying for regulatory approval to operate independent payment networks. As these initiatives gain momentum, the fintech sector is poised for further disruption and innovation in the payments domain.